建设估计年代oftware Market Size, Share & Trends Analysis Report By Software License, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-005-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry:Technology

Report Overview

的global construction estimating software market size was valued at USD 1.34 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.3% from 2022 to 2030. The current growth of the market can be attributed to the rising construction activities and shift in construction companies' focus on optimizing the cost of the project. Aggressive growth in the construction activities being undertaken across the globe is prompting companies to integrate lean principles into construction processes to reduce waste, improve productivity, and cut costs supporting the market trend. The spread of the COVID-19 virus in early 2020 has negatively impacted the construction estimating software market for the first three quarters of 2020. However, various companies have leveraged the increasing digitalization and internet penetration amid the pandemic to advertise their products and expand their customer base. This encouraged construction companies to digitize business operations such as construction designing, estimating, and fleet management, among others.

的growing demand for construction estimating software is encouraging software vendors to adopt various business strategies to increase their net sales. Industry players are focusing on improving their client network by partnering with construction design companies to enhance their market revenue and expand their service network. For instance, in March 2022, Cost Certified, a construction estimating software provider, partnered with Cedreo, a Software-as-a-Service (SaaS) provider for 3D home design, to develop a single platform with estimation and designing tools for residential projects. Cost Certified planned to integrate its construction estimating software on the platform with a simplified interface.

COVID-19 pandemic has disrupted the construction industry across the globe, affecting the economic growth of most countries. To revive the pandemic-affected economy, governments of various countries are investing in the construction sector, creating robust opportunities for the construction estimating software market. Governments are launching multiple infrastructure development projects, including the construction of houses, commercial buildings & bridges, and their maintenance, supporting market growth.

For instance, in September 2021, the Government of the U.K. announced to spend USD 900 billion in private & public construction and infrastructure development in the next ten years. The government has aimed to complete projects worth USD 200 billion by 2025, creating jobs for 425,000 people per year in this duration.

Various government initiatives to establish digital infrastructure are also accelerating the adoption of construction estimating software. Various government-authorized organizations are developing software to prepare cost structures for the different construction and infrastructure development projects. For instance, in June 2022, the Public Works Department (PWD) of India announced the launch of construction and project estimator software to calculate the funds required to commence the project and strengthen transparency in the system. PWD will also make the software compatible with other construction software such as asset monitoring & tracking and quality checking tools to improve the adaptability of the estimator software.

的high initial costs of the software and evolving digital threats are the two key factors expected to hamper the market growth during the forecast period. The software development process for construction estimating software is costly as the provider needs to hire expert software engineers and implement advanced software testing and assessment tools. The market players are adopting various business strategies to reduce the costs of construction estimating software.

的y are also focusing on mergers & acquisitions to improve their service product portfolios and technological expertise, which allow them to reduce software prices. For instance, in March 2022, JDM Technology Group, a global construction software company, acquired CavSoft, a construction estimating Software Company, for an undisclosed amount. CavSoft merged with JDM Technology Group’s subsidiary (Spearhead Software) in Australia.

Software License Insights

的subscription license segment held a market share of 56.6% in 2021. The segment growth can be attributed to the growing preference for subscription business models and the strong emphasis on customer retention, reducing subscriber churn, and ensuring regulatory compliance. Advances in cloud computing have particularly added flexibility to the subscription-based license models. As a result, several providers of construction estimating software have started partnering with cloud service providers to offer their respective software on a subscription license. A subscription-based license model also allows construction companies to increase customer engagement and subsequently augment their sales by providing efficient services to their customers.

的perpetual license segment is expected to expand at a CAGR of 6.5% during the forecast period. A perpetual license allows indefinite use of the software for a one-time fee. However, technical support and software updates might be limited for the initial years. After the technical assistance period is over, the customer may opt for new software or continue using the existing perpetual licensed construction estimating software without any software updates and technical support. Nevertheless, a perpetual license also involves a high level of customization or integration in line with the customer’s requirement, thereby giving customers more control over security and more insights into the situation. These benefits associated with perpetual licensed software are expected to drive the growth of the segment during the forecast period.

Deployment Insights

的cloud segment accounted for the largest market share 50.3% in 2021. As the construction industry continues to evolve, the adoption ofcloud computingis higher within the industry as construction companies are considering cloud deployment the most preferred way to deploy construction estimating software. Cloud deployment ensures cost-efficiency while also increasing productivity by allowing the use of data to streamline processes. Several large enterprises, such as Autodesk and Microsoft Corporation are offering construction estimating software over the cloud.

For instance, in October 2021, Autodesk, Inc. launched a new feature across Autodesk Construction Cloud and expanded its partner ecosystem as part of its efforts to connect workflows on a single platform.

的on-premise segment is anticipated to expand at a CAGR of 6.0% throughout the forecast period. The increasing complexity of real-time collaboration among project stakeholders, and large upfront capital investments, to purchase and manage the software along with hardware, servers, and other facilities, are driving the segment growth. On-premise solutions typically provide high data security for construction projects while facilitating functionalities, such as estimating, job costing, project design and scheduling, and project management, among others.

For instance, Sage Group’s Sage 300 Construction and Real Estate Management is an on-premise solution that can be installed on a company’s server and accessed from licensed workstations. The solution guarantees a high level of customization and flexibility.

Enterprise Size Insights

的large enterprise segment accounted for the largest market share of 61.6% in 2021. Several large enterprises, such as DPR Construction, Granger Construction, and Eckardt Group, among others, have deployed construction estimating software as part of their efforts to reduce errors while ensuring cost efficiency, data privacy, and flexibility. Large construction companies are also using construction estimating software to efficiently track costs and manage the budget of the project during the project's lifecycle. For instance, construction accounting software Project Pro is designed to deliver better business control and streamline the accounting for large construction firms. The software particularly assists businesses in streamlining their processes by providing better insights into the overall project costs, resource requirements, and resource allocation.

小型和中型企业段预计to register a significant CAGR of 9.8% during the forecast period. The advances in cloud computing, the agility offered by cloud-based solutions, and the increase in profitability associated with the adoption of cloud-based solutions are encouraging SMEs to opt for cloud-based solutions. They are also leveraging automation services to handle project-related inquiries effectively and easily. For instance, in March 2022, PataBid, a construction technology company, designed an Artificial Intelligence (AI)-powered, cloud-based construction estimating software to provide small-sized and medium-sized electrical and mechanical contractors with an effective tool for cost estimation.

End-use Insights

的architects & builders segment accounted for the largest market share of 40.2%, which was valued at USD 538.7 million in 2021. Advances in Virtual Reality (VR) and Augmented Reality (AR) technologies and their continued integration into architecture, engineering, and consulting software coupled with the significant growth in the number of construction projects, are expected to open lucrative opportunities for architects and builders, thereby driving the adoption of construction estimating software during the forecast period. Several architects and consultants use interior design software to reduce their reliance on paperwork and documentation while expediting the design process, ensuring well-organized work sites and well-developed designs, plus lowering the overall interior design costs.

的contractor segment is expected to register the highest CAGR of 9.2% through 2030. With the help of construction estimating software, contractors and subcontractors can enhance project efficiency and accountability by streamlining project communication and documentation and improving market representation. For instance, Sage 100 contractor, a construction management solution used by several small-sized and mid-size contractors, is an integrated construction management solution featuring tools for accounting, estimating, scheduling, project management, equipment management, and payroll management. The solution aids in planning the tasks and finalizing the objectives, creating better estimates, and managing job costs.

Regional Insights

的North American regional market dominated the construction estimating software market in 2021 and accounted for a market share of 37.4%. The regional growth can be attributed to the rapid industrialization and large-scale adoption of digital technologies such as cloud computing and theInternet of Things(IoT) by engineers, architects, and builders. Established market players such as Autodesk Inc., Procore Technologies, and Oracle Corporation in the U.S. are effectively working on new product development and enhancement of existing products to attract customers and capture more market shares.

For instance, in June 2020, Procore Technologies, a U.S.-based construction management company, introduced new features in the Procore platform to enhance collaboration and communication in construction. The new features include action plans, real-time labor costing, custom and configurable fields, and a web-based 3D model viewer.

Asia Pacific is expected to expand at a significant CAGR of 9.4% throughout the forecast period due to the considerable government initiatives pursued by multiple countries toward commercialization, increasing infrastructure development, and developing smart cities. Furthermore, significant investments in advanced technologies and growth in the construction sector have propelled the demand for construction estimating software in the region. The increasing application of lean management in construction-related operations and surging technological advancements have significantly propelled the growth of the construction estimating software market in India, Japan, and China.

Key Companies & Market Share Insights

市场参与者是观察到的投资资源research & development activities to support growth and enhance their internal business operations. Companies can be seen engaging in mergers & acquisitions and partnerships to further upgrade their products and gain a competitive advantage in the market. They are effectively working on new product development, and enhancement of existing products to acquire new customers and capture more market shares.

For instance, in May 2021, Glodon Company Limited announced a partnership with JTC Corporation, an industrial infrastructure developer. The partnership aimed to promote cooperation and create a framework for construction project cost control. Building information modeling, a method for creating digital representations of physical infrastructure, was integrated into cloud-based cost management systems as part of this partnership. The technology-enabled data sharing and feedback among multiple project stakeholders, including owners, consultants, and contractors, boost collaboration throughout the development cycle. Some prominent players in the global construction estimating software market include:

AppliCad Public Company Limited

Autodesk Inc.

Blue beam Software Inc.

Corecon Technologies, Inc.

Glodon Company Limited

Microsoft Corporation

PrioSoft Construction Software

RIB Software SE

Sage Group plc

Trimble, Inc.

建设估计年代oftware Market Report Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 1.38 billion |

Revenue forecast in 2030 |

USD 2.62 billion |

Growth Rate |

CAGR of 8.3% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2017 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, trends |

Segments Covered |

Software license, deployment, enterprise size, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; South America; Middle East & Africa |

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil |

Key companies profiled |

AppliCad Public Company Limited; Autodesk Inc.; Blue beam Software Inc.; Corecon Technologies, Inc.; Glodon Company Limited; Microsoft Corporation; PrioSoft Construction Software; RIB Software SE; Sage Group plc; Trimble Inc. |

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global建设估计年代oftware MarketSegmentation

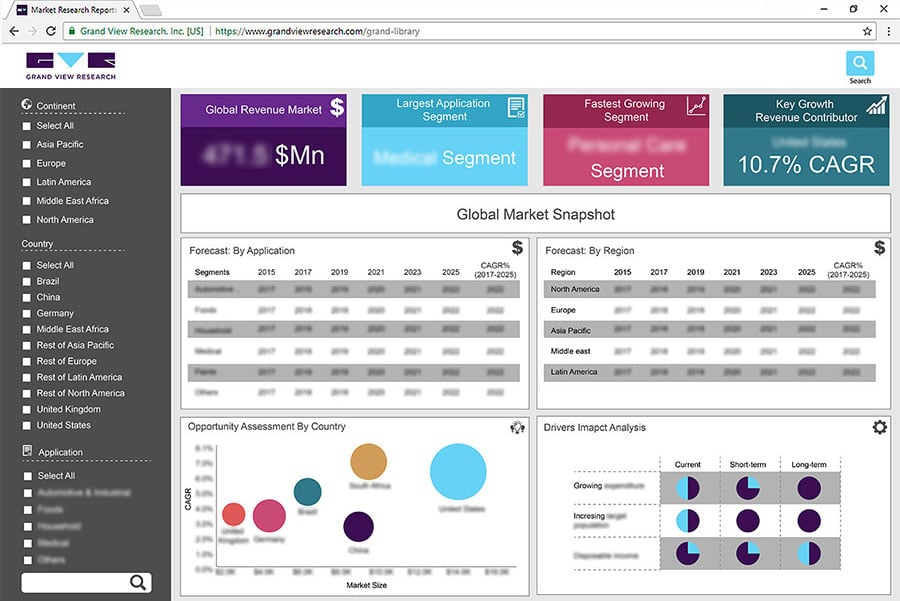

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global construction estimating software market report based on software license, deployment, enterprise size, end-use, and region:

Software License Outlook (Revenue, USD Million, 2017 - 2030)

Perpetual License

Subscription License

Others (Free Source, Open Source)

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

Cloud

On-premise

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

Small and Medium Enterprises

Large Enterprises

End-use Outlook (Revenue, USD Million, 2017 - 2030)

Architects & Builders

Construction Managers

Contractors

Others (Professional Contractors, Consultants, Designers, Government Agencies)

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

Asia Pacific

China

India

Japan

Latin America

Brazil

Middle East & Africa

Frequently Asked Questions About This Report

b.的global construction estimating software market size was estimated at USD 1,339.4 million in 2021 and is expected to reach USD 1.38 billion in 2022.

b.的global construction estimating software market is expected to grow at a compound annual growth rate of 8.3% from 2022 to 2030 to reach USD 2.62 billion by 2030.

b.North America held the largest share of 37.4% in 2021 due to the rapid industrialization and large-scale adoption of digital technologies such as cloud computing and the Internet of Things (IoT) by engineers, architects, and builders.

b.Some key players operating in the sales training software market include AppliCad Public Company Limited; Bluebeam Software Inc.; Corecon Technologies, Inc.; Glodon Company Limited; Microsoft Corporation; PrioSoft Construction Software; RIB Software SE; Sage Group plc; and Trimble, Inc

b.的current growth of the market can be attributed to rising construction activities and shifting construction companies' focus on optimizing the cost of the project. Aggressive growth in the construction activities being undertaken across the globe is prompting companies to integrate lean principles into construction processes to reduce waste, improve productivity, and cut costs supporting the market trend.